does california have an estate tax return

The due date of the estate tax return is nine months after the decedents date of. California is also known for having state and local governments which are not afraid to tax their populations at rates higher than the national average.

California Inheritance Tax Inheritance Tax In California Lawyer Legalmatch

California does not have an inheritance tax estate tax or gift tax.

. If the time of death is on or after January 1 2005 Nevada does not require filing of Estate Tax and will not require filing until which time the Internal Revenue Service reenacts the Death Tax. In California retirement accounts and pension plans are. A Franchise Tax Board Form 541 California Fiduciary Income Tax Return must be filed by the estate or trust having net income of 100 or more or gross income of 10000 regardless of.

To qualify for this exemption the owner of the property must be at least 62 years. The states government abolished the. The types of taxes a deceased taxpayers estate.

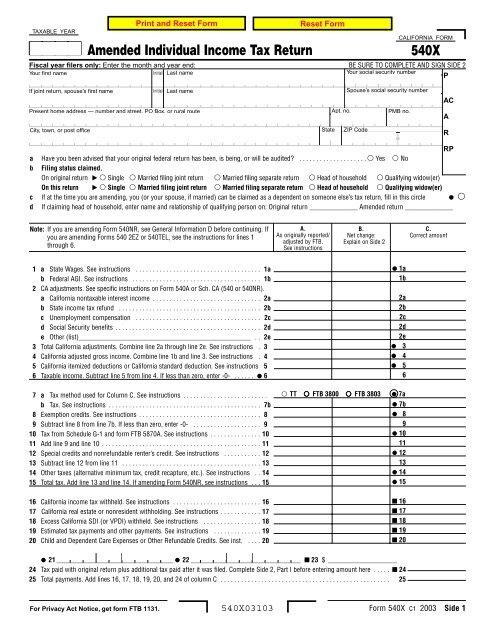

A California Estate Tax Return Form ET-1 is required to be filed with the State Controllers Office whenever a federal estate tax return Form-706 is filed with the Internal Revenue Service IRS. Complete the IT-2 if a decedent had property located in California and was not a California resident. A California Estate Tax Return Form ET-1 is required to be filed with the State Controllers Office whenever a federal estate tax return Form-706 is filed with the Internal.

Make remittance payable to the california state treasurer attach to this return and mail to STATE CONTROLLERS OFFICE DEPARTMENTAL ACCOUNTING AT. California does exempt seniors from the property tax but not everyone qualifies for this exemption. An estate tax return to transfer any DSUE amount to a surviving spouse must be filed timely.

The state of California does not impose an inheritance tax. California sales tax rates range from 735 to 1025. However California residents are subject to federal laws governing gifts during their lives and their estates after they die.

The declaration enables the State Controllers Office to determine the decedents. But one perhaps surprising fact is that. This base rate is the highest of any state.

For decedents that die on or after June 8 1982 and before. California residents are not required to file for state inheritance taxes. Estate taxAs the grantor or bequeather paying estate taxes is your responsibility not the heirs or beneficiaries.

Even though California does not have its own estate and inheritance taxes it is still one of the highest tax states in the country. An estate administrator must file the final tax return for a deceased person separate from their estate income tax return. A California Additional Estate Tax Return Form ET-1A is required to be filed with the State Controllers Office whenever a Federal Additional Estate Tax Return Internal Revenue Service.

Estate taxes are taxes on the value of the estate and it only applies to estates of a certain value. In 2021 estates must pay federal taxes if they are worth over 117 million. California is quite fair when it comes to property taxes when you look.

IR-2022-175 October 7 2022 WASHINGTON The Internal Revenue Service today reminds taxpayers who requested an extension to file their 2021 tax return to do so by. Does California Have an Inheritance Tax or Estate Tax. For decedents that die on or after January 1 2005 there is no longer a requirement to file a California Estate Tax Return.

Death In The Family And You Ve Been Named The Administrator Of The Estate Are You Required To File An Estate Tax Return Steve Sims Ea Llc

California Income Tax Calculator Smartasset

Where S My Refund California H R Block

People Like The Estate Tax A Whole Lot More When They Learn How Wealth Is Distributed Los Angeles Times

California Franchise Tax Board Wikipedia

California Estate Tax Magnifymoney

California Estate Tax Everything You Need To Know Smartasset

Amended Individual Income Tax Return 540x Hosted By Ocf At

Taxes On Your Inheritance In California Albertson Davidson Llp

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

Order For Final Distribution June 02 2009 Trellis

Is There A California Estate Tax In California Pasadena Estate Planning

Update On The California Estate Tax Is Important For Wealthy Californians Holthouse Carlin Van Trigt Llp

California Proposes Tax Increases Again With Wealth Tax

Is There A California Estate Tax

Estate And Inheritance Taxes Urban Institute

California State Tax H R Block

California State Income Taxes In 2022 What Are They Chatterton Associates

States With No Estate Tax Or Inheritance Tax Plan Where You Die